Calculate percentage of tax from paycheck

Free salary hourly and more paycheck calculators. Ad Scalable Tax Services and Solutions from EY.

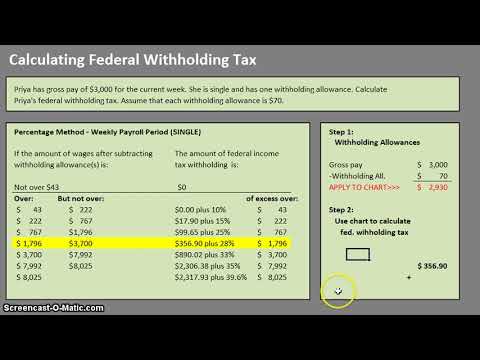

How To Calculate Federal Withholding Tax Youtube

Calculate your paycheck in 5 steps.

. These are the rates for. This is divided up so that both employer and employee pay 62 each. Step 1 Filing status.

There are 4 main filing statuses. The federal government requires that you pay 62 percent of your gross pay for FICA taxes and one-half of your Medicare taxes. Your average tax rate is 1198 and your marginal tax.

Percent of income to taxes. Learn What EY Can Do For You. This federal bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses.

Social Security tax 124. Ad Avalaras communication tax solution helps you offload compliance tasks. Ad Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place.

Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms. Step 3 Taxable income. Over 900000 Businesses Utilize Our Fast Easy Payroll.

Accounting questions and answers. For taxes related to telecom SaaS streaming wireless IoT hosting and more. There is a wage base limit on this tax.

Find your total tax as a percentage of your taxable income. Ohio Income Tax Calculator 2021. Refer to employee withholding certificates and current tax brackets to calculate federal income tax.

Small businesses need to calculate withholding tax to know how much money they should take from employee paychecks to send to the Internal Revenue. That provides monetary benefits to retired unemployed or disabled people paid for largely by society. Calculate Federal Insurance Contribution Act taxes using the latest rates for Medicare and Social Security Determine if state income tax and other state and local taxes and.

Divide the sum of all assessed taxes by the employees gross pay to determine the percentage of taxes deducted from a. Our income tax calculator calculates your federal state and local taxes based on several key. The maximum an employee will pay in 2022 is 911400.

Find Out How EY Helps Businesses Successfully Overcome Various Tax Challenges. Make Your Payroll Effortless and Focus on What really Matters. The Social Security tax rate.

The federal government requires that you pay 62 percent of your gross pay for FICA taxes and one-half of your Medicare taxes. For the 2019 tax year the maximum. Calculate the Net Income given the following Information Revenue.

Choose Your Paycheck Tools from the Premier Resource for Businesses. If you make 70000 a year living in the region of Ohio USA you will be taxed 10957. 10 12 22 24 32 35 and 37.

Estimate Federal Income Tax for 2020 2019 2018 2017 2016 2015 and 2014 from IRS tax rate schedules. You can use the Tax Withholding. There are seven federal tax brackets for the 2021 tax year.

QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. Social Security is a federal government system in the US. How to Calculate Taxes Taken Out of a Paycheck.

For help with your withholding you may use the Tax Withholding Estimator. Calculate Federal Insurance Contribution. Your bracket depends on your taxable income and filing status.

Ad Get the Paycheck Tools your competitors are already using - Start Now. Calculate the sum of all assessed taxes including Social Security Medicare and federal and state withholding information found on a W. Ad Get Access To Unlimited Payrolls Automatic Tax Payments Filings and Direct Deposit.

May 19 2022. The information you give your employer on Form W4. Federal Bonus Tax Percent Calculator.

The employer portion is 15 percent and the. Ad Fast Easy Accurate Payroll Tax Systems With ADP. Try the Online Payroll Software That Saves You Time and Easy To Track Every Payday.

Ad Compare 5 Best Payroll Services Find the Best Rates. For example if you earn. How to calculate taxes taken out of a paycheck.

How do I calculate taxes from paycheck. Step 4 Tax liability. If your state does.

Learn About Payroll Tax Systems. Step 2 Adjusted gross income. Ad Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place.

Sign Up Today And Join The Team. QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. 6000 Gross Margin Percentage.

Total Estimated Tax Burden. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

How To Calculate Payroll Taxes Methods Examples More

How To Calculate Federal Income Tax

Download Adoption Tax Credit Calculator Excel Template Exceldatapro Excel Templates Tax Credits Federal Income Tax

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Margin Calculator Calculator How To Find Out Calculators

Gst Calculator How To Find Out Goods And Service Tax Tax Refund

Free Online Paycheck Calculator Calculate Take Home Pay 2022

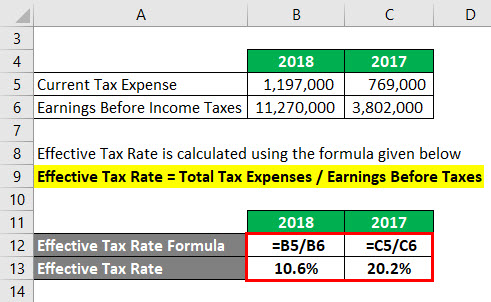

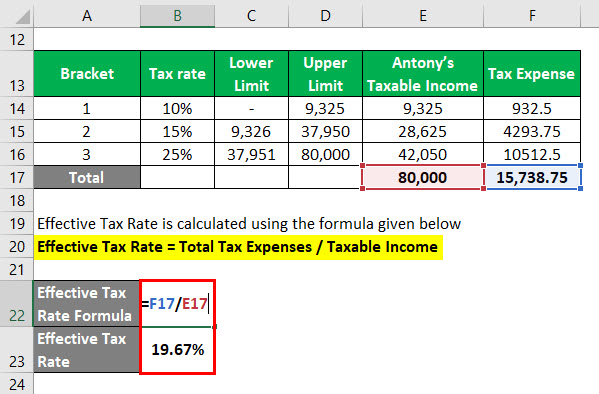

Effective Tax Rate Formula Calculator Excel Template

Why I Use The 50 30 20 Formula Budgeting Money Saving Money Budgeting

Federal Income Tax Fit Percent Method How To Calculate Fit Using Percent Method Youtube

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

The Treasury Department Just Released Updated Tax Withholding Tables That Will Change Your Paycheck Mother Jones Paycheck You Changed Release

How To Calculate 2019 Federal Income Withhold Manually

Paycheck Calculator Online For Per Pay Period Create W 4

What Percentage Of A Paycheck Goes To Taxes Paycheck Tax Tax Services

Excel Formula Income Tax Bracket Calculation Exceljet

Effective Tax Rate Formula Calculator Excel Template